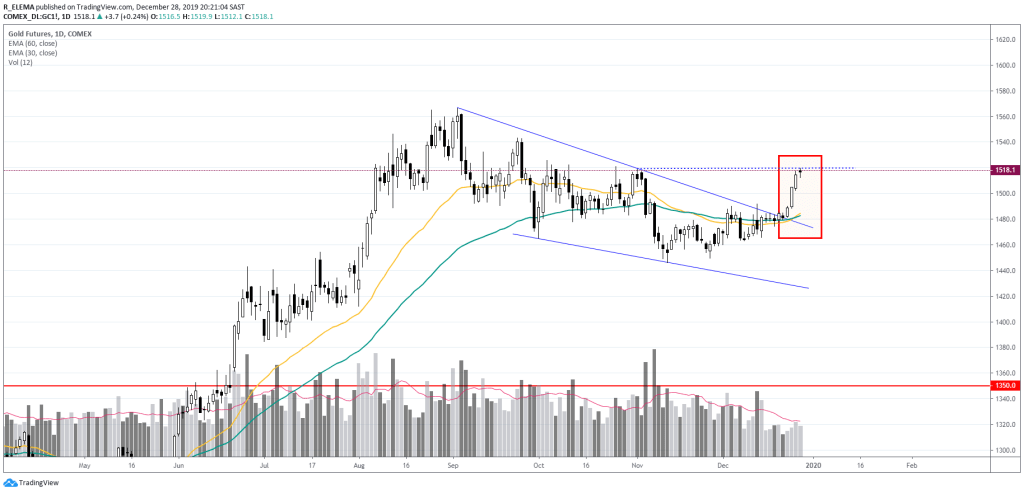

I have been keeping my eyes on gold the last couple of months after we broke through long term 1350$ resistance. After a convincing run up to 1560$ the yellow metal retreated and formed what seemed to be a descending pennant formation. Together with this pullback from the highs, gold also faded from public view.

About a week ago, we seem to have broken out of this pattern, once again bringing all eyes back to the precious metal. Since then we have seen a stellar performance, with a ~2.5% climb in the past 7 days. Currently we are facing the 1520$ resistance.

Because of this run in gold, the South African gold mining stocks have obviously seen a reaction.

Above the South African Gold Mining Index can be observed, with its correlated movement with the gold price.

This index has seen a 6.5% growth the past week as the future profitability of gold mining companies is calculated into the price of their stocks. Resistance is 2800,which was broken on Friday the 28th before sellers stepped in and price retreated.

A trade idea I thought of to gain exposure to this move is to look at Warrants that are available on the underlying Gold Mining stocks themselves that are listed on the JSE.

Of the warrants that are available on the Standard Bank platform is Goldfields and AngloGold Ashanti. I selected these two warrants because of they have more than 90 days outstanding and because they have a Deltas of more than 60%.

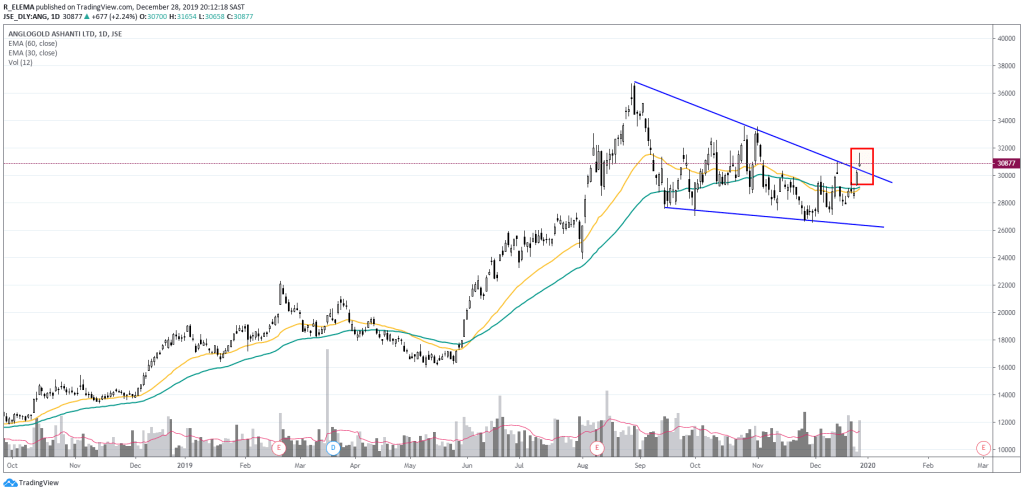

Below these two stocks can be observed:

Anglogold also has a price closely correlated with the gold price, as can be seen in the similarity in the shape of their charts. ANG looked like the weaker one of the two from the get to, as during the forming if it’s decending pennant formation over the last couple of months it has spent a lot of time beneath its 30 day EMA.

Since gold’s run, ANG’s price climbed around 10% over the last couple of days, gaping up both on the 25th and the 27th.

Goldfields has shown good strength the last coupe of months by staying above its 30Day EMA for some time as it formed what seems to be a Symmetrical Triangle formation.

As with Anglogold, GFI has shown great strength the last couple of days and gained around 10%, and is currently facing 9500c major resistance.

The price did cross over the 9500c line on Friday the 27th, before retreating back down to 9311c by closing.

GFI will have to prove itself by breaking 9500R convincingly. A good retest of resistance-turned-support of the top of the pattern is also preferable.